In business, the terms "margin" and "markup" are often used interchangeably as the monetary value of them is the same. However, there is a big difference between the two when you’re measuring them as a percentage. While markup and margin are the same monetary value, their reference point for measurement is very different, and therefore the percentage margin or markup will be different. In this article we are going to show you the difference between the two, why you shouldn’t confuse them, and the impact applying one instead of the other will have on the bottom line of your business.

What are margin and markup?

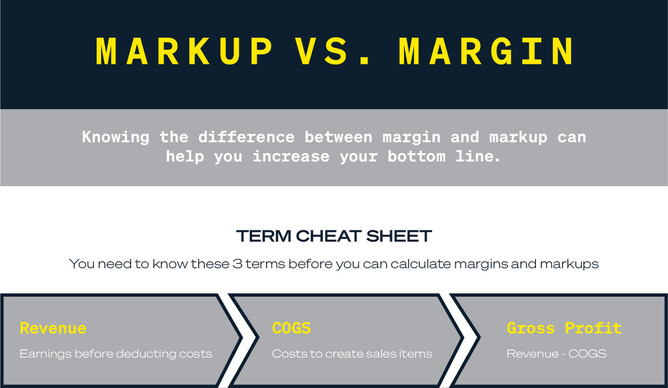

What is margin?

Margin is the difference between your sale price of a good or service and the amount of money required to produce it e.g. if you sell something for $100, and purchase it for $50, there is $50 margin. This is also commonly referred to as gross profit.

What is markup?

Mark up is the value of money added to your purchase price of a good or service to determine the price you sell it for e.g. if you purchase something for $50, and sell it for $100, there is $50 mark up.

But those sound the same!

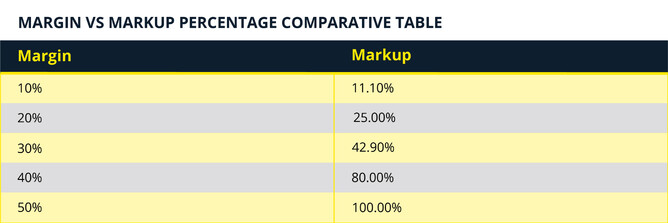

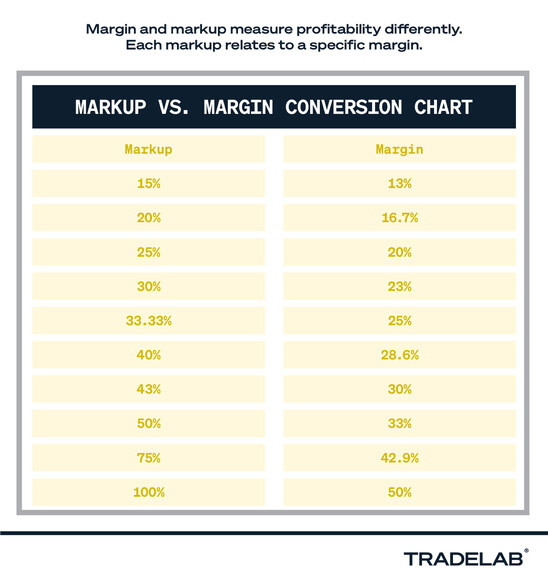

You’re correct. And that is why so many people confuse the two. When people talk about margin and markup, or you apply it in your business, it's expressed as a percentage. “Oh, yeah I add 30% margin on everything” as an example.

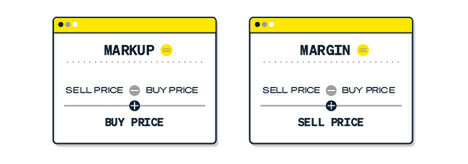

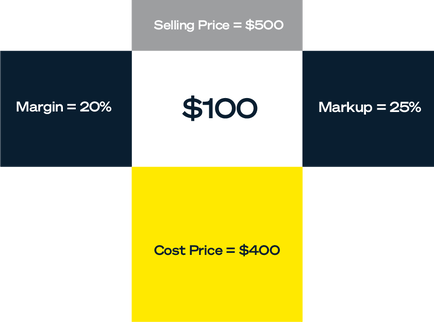

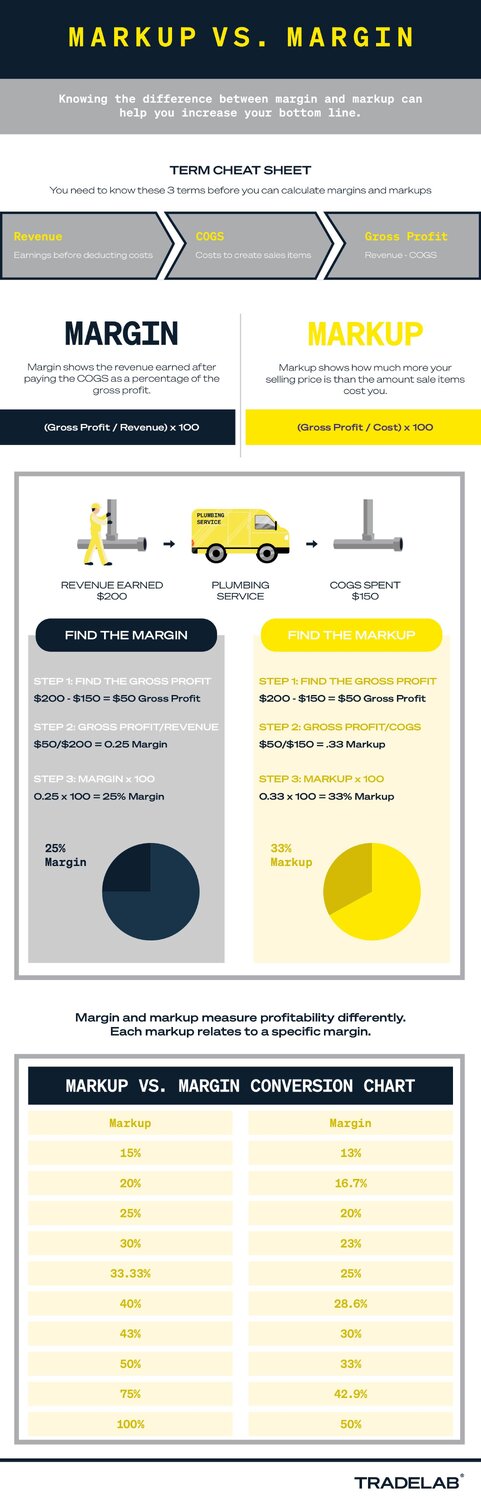

The key thing to differentiate them is where they are measured from. Margin is measured from your sale price, whereas mark up is measured from your purchase price.

In this article we’re going to break margin and mark up down, how to calculate them, and the impact misapplying them in your business can have on your bottom line.

Calculating margin and markup?

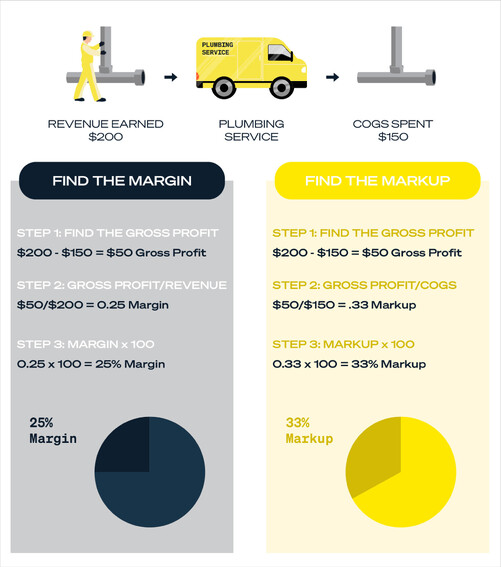

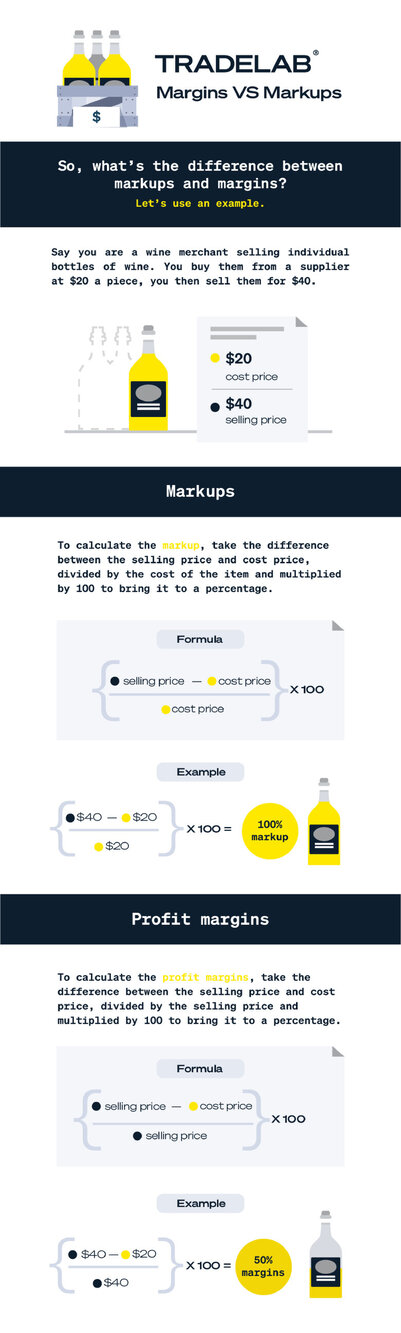

How to calculate margin?

To calculate margin, you deduct your purchase price from you sell price and divide it by your sell price.

For example, if you sell something for $100 and purchase it for $50, there is a $50 margin. Once you divide the $50 margin by the $100 sell price, you have a 50% margin.

Using the same example, but with a purchase price of $70 you have $30 margin ($100 - $70 = $30). Once you divide $30 by $100 you have a 30% margin.

How to calculate mark up?

To calculate mark up, you deduct your purchase price from you sell price and divide it by your purchase price.

For example, if you sell something for $100 and purchase it for $50, there is a $50 mark up. Once you divide the $50 mark up by the $50 purchase price, you have a 100% mark up.

Using the same example, but with a purchase price of $70 you have $30 mark up ($100 - $70 = $30). Once you divide $30 by $70 you have slightly less than a 43% mark up.

Why is this important?

So, what does this actually mean to my business?

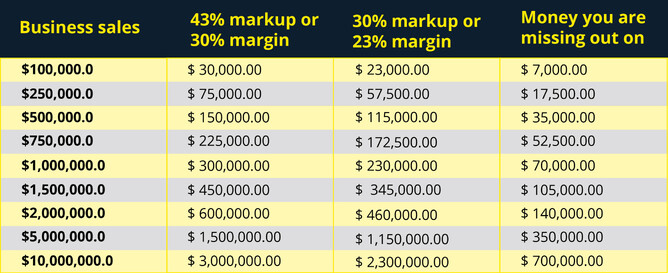

The applied markup vs margin table below shows how much gross profit you would make by achieving a 30% margin vs a 30% markup, as well as the money you’d be missing out on based on misapplying the percentage value.

The bottom line on understanding margin and mark up, and why it’s so important

Applying margin and markup to your business correctly is incredibly important to the sustainable growth of the business, and the money you make as the business owner.

Often when businesses are struggling, its not because they’re not bringing enough work in as much as it is that they are not making enough money on the work they are bringing in.

This has a knock-on effect where businesses start under charging for their services, and then force other businesses to reduce prices to compete with them, thus making it harder for everyone to make money to survive.

If you’re running a million-dollar business and making this mistake (and believe us, there are people with bigger businesses than this making this mistake!), you’re missing out on $70k from your back pocket and working harder than you need to be.